Three manufacturing costs Direct material cost: Consist of all those material that can be identified with a specific product. Example: wood used in manufacturing. - ppt download

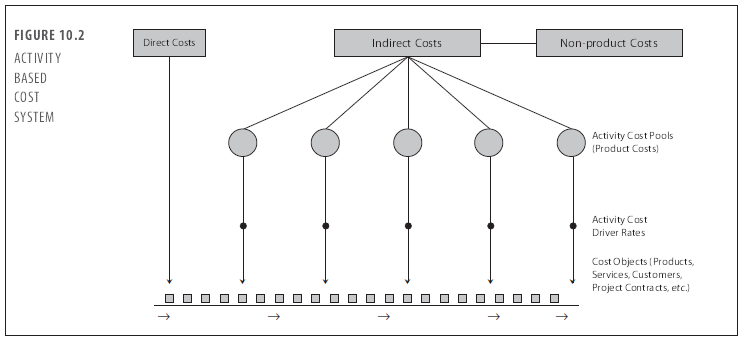

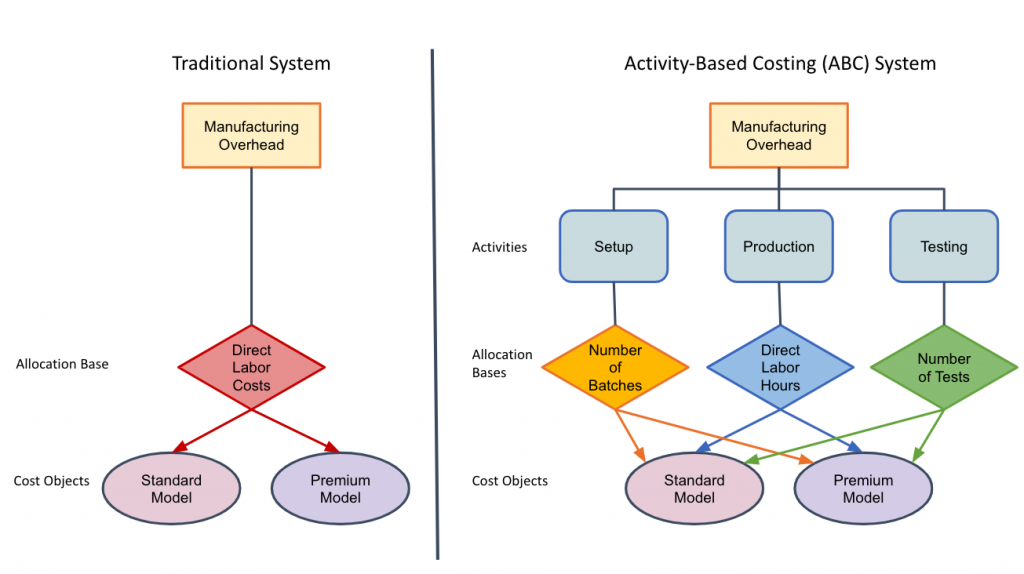

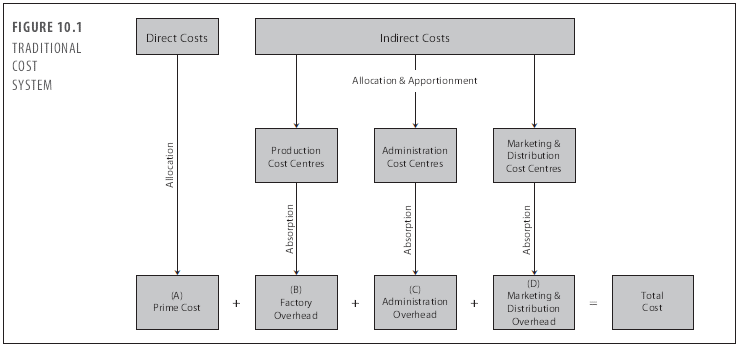

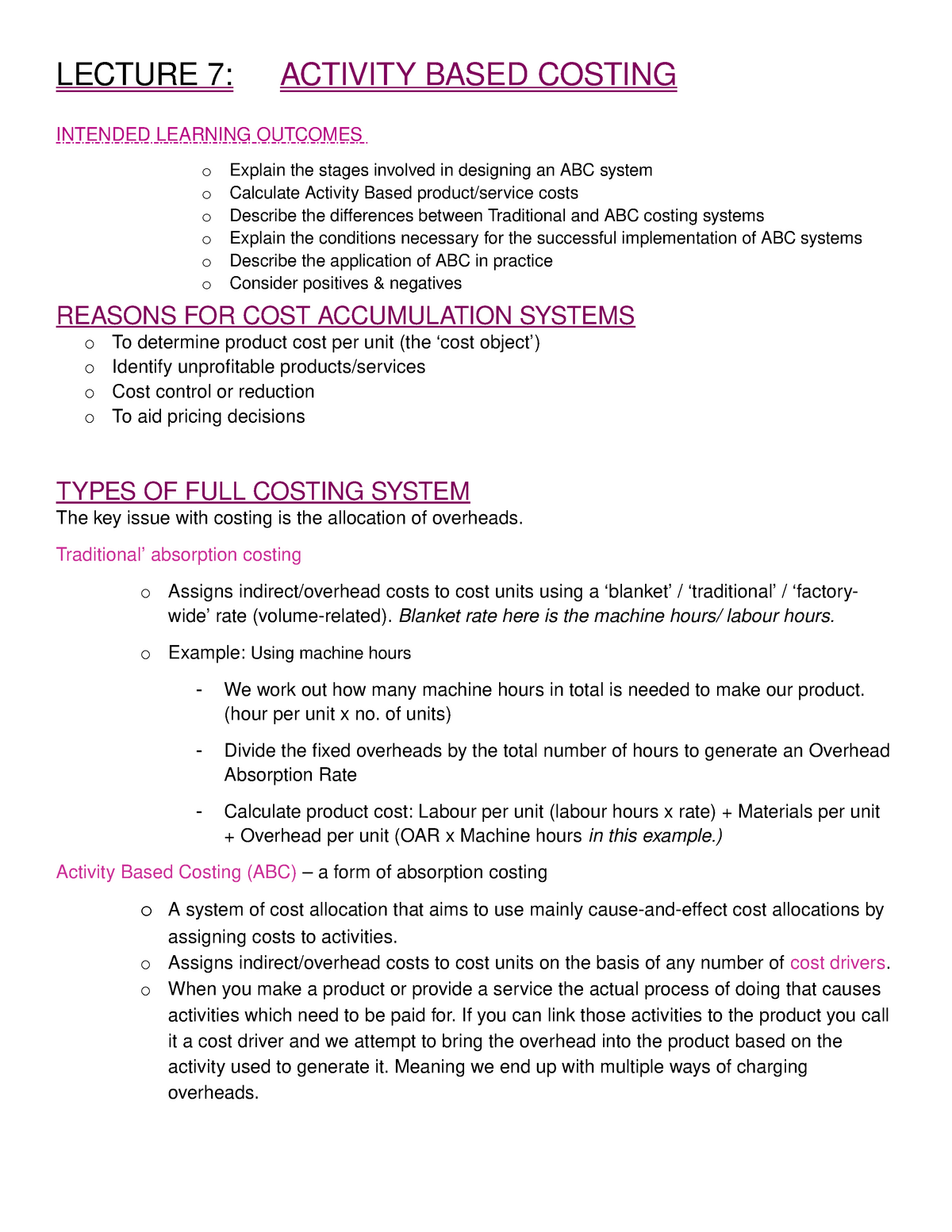

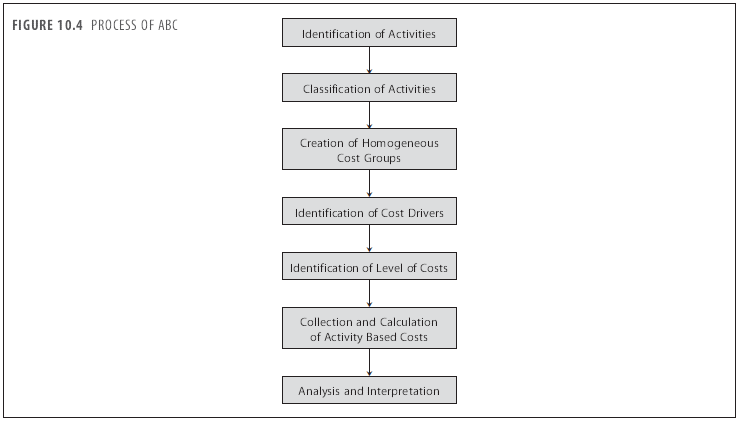

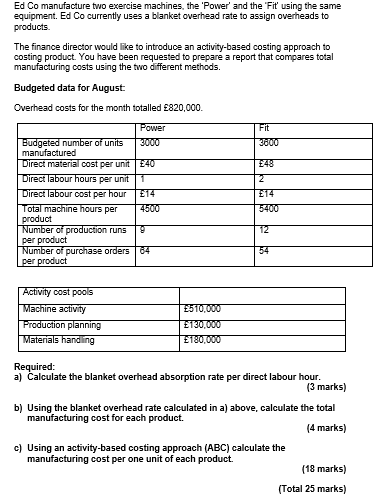

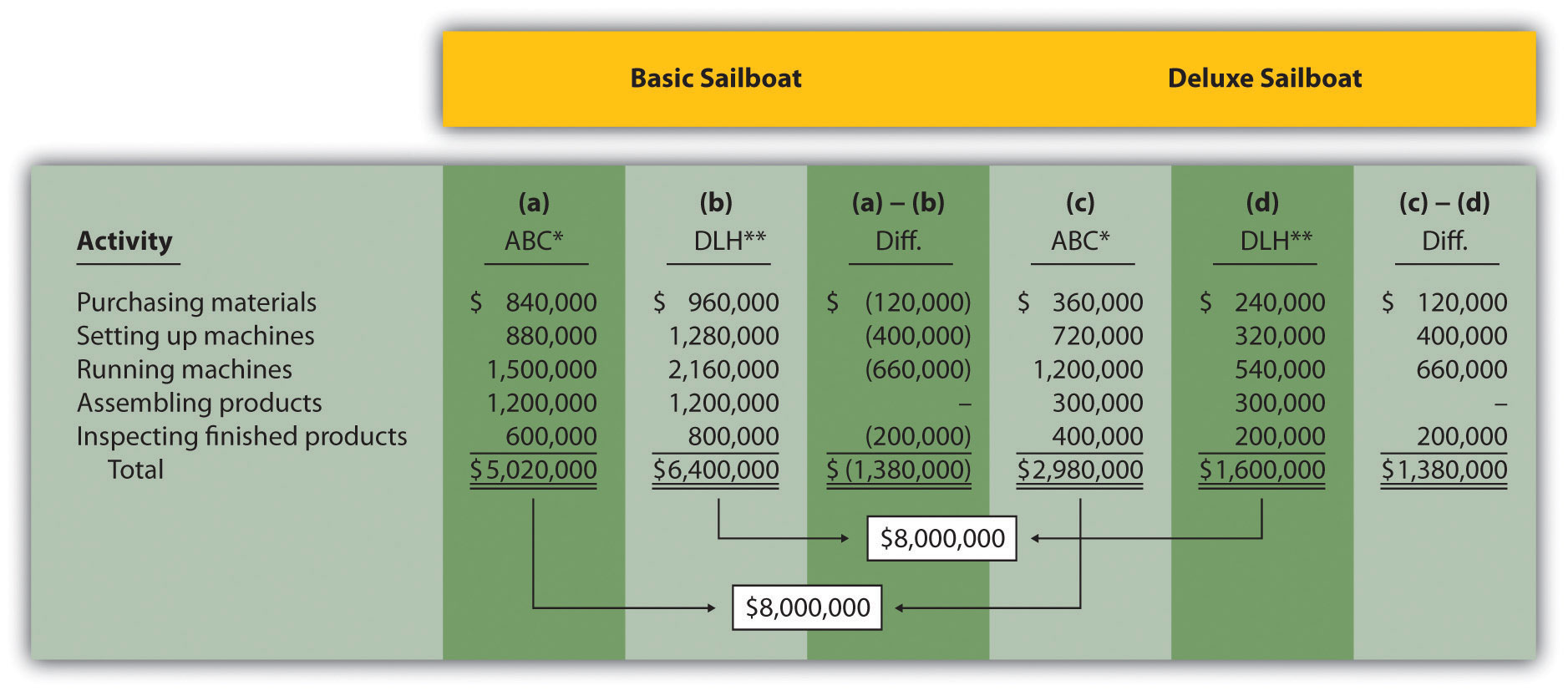

Lecture 7 Activity based costing - o Explain the stages involved in designing an ABC system o - Studocu

:max_bytes(150000):strip_icc()/overhead-rate-primary-FINAL-02d6db65cff64f82b763454ebce4fe52.png)